How Much Do People Get for a Car Loan

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions. Our marketing partners don't review, approve or endorse our editorial content. It's accurate to the best of our knowledge when posted.

Advertiser Disclosure

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

If you're in the market for a car, there's a good chance you'll have to finance your purchase with an auto loan.

That means you'll probably also be doing some math around the kind of monthly payment you can afford. Overall, Americans are paying more to drive their cars these days, whether the vehicle is leased or purchased.

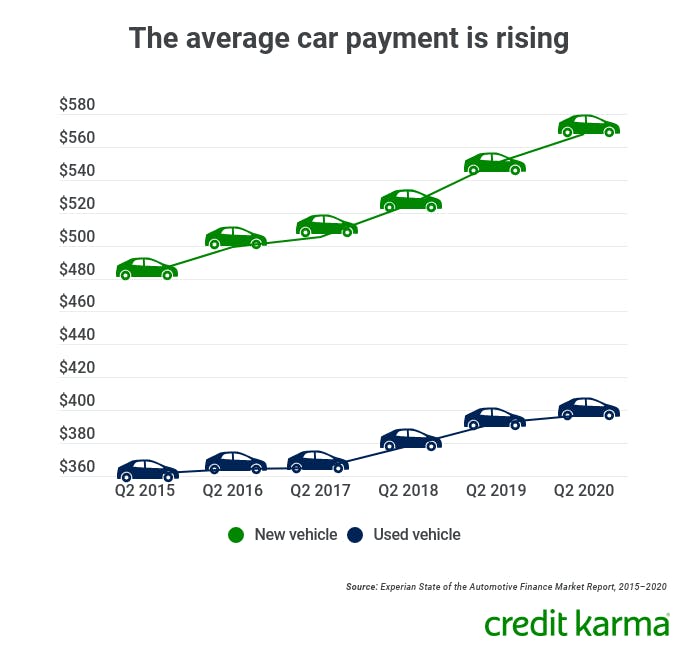

The average monthly car payment was $568 for a new vehicle and $397 for used vehicles in the U.S. during the second quarter of 2020, according to Experian data. The average lease payment was $467 a month in the same period.

Let's take a look at the trends of average car payments and loan length, and review tips for nailing down a car payment that fits your budget.

- Average car payment in 2020 vs. 2019

- How is my car payment determined?

- How can I lower my monthly car payment?

Average car payment in 2020 vs. 2019

The average new-car price reached $38,378 in July 2020 — a 2% increase from July 2019, according to Kelley Blue Book. Other data, from Experian, shows monthly car payments overall have risen, too.

As you can see in the chart below, which is based on Experian data, car payment costs were up in the second quarter of 2020 compared to the second quarter of 2019 across both new and used vehicles. That includes cars that were financed with a loan or leased.

Image: aaverifiedavgpayment

Image: aaverifiedavgpayment The data also shows that many people have been buying cars with auto loans that last nearly six years (72 months). Leases continue to average a little more than three years (over 36 months).

| U.S. auto loans | ||||||

|---|---|---|---|---|---|---|

| New cars | Used cars | Leased cars | ||||

| Q2 2020 | Q2 2019 | Q2 2020 | Q2 2019 | Q2 2020 | Q2 2019 | |

| Average monthly payment | $568 | $550 | $397 | $392 | $467 | $458 |

| Average loan term (months) | 71.54 | 69.17 | 65.30 | 64.82 | 36.66 | 36.76 |

Table based on Experian data from Q2 2020.

How is my car payment determined?

Here are some factors that go into your monthly car payment.

- Principal — The amount of money you borrow to purchase the car will likely be the biggest factor in your monthly payment. This is known as your loan principal. For example, if your loan amount is $20,000, you'll probably have a lower monthly payment than if you borrow $30,000.

- Interest — Your loan's interest rate also figures highly in your monthly car payment. Interest is essentially the cost you pay to borrow money. The higher your interest rate, the higher your monthly payment will likely be. The interest rate you get (and therefore your monthly car payment) can be affected by a range of factors, including …

- Credit scores — Average interest rates for auto loans are typically lower for people with solid credit than for people whose credit needs more work.

- Vehicle age — Interest rates for used-car loans are generally higher than for new-car financing. But if you buy a used car, you may pay less overall because of the lower price tag, despite a higher interest rate.

- Your lender — Credit union car loans typically have lower interest rates than loans from banks. And if you have excellent credit, you may be able to qualify for a 0% APR promotion offered by an automaker's finance company. But be aware that if you get your financing through a dealership, you could end up with a higher interest rate than if you went directly to a bank or credit union. This is because dealers may mark up your interest rate as compensation for arranging your financing.

- Fees and taxes — Your auto loan or lease will likely include fees that can be rolled into your monthly payments, like vehicle registration fees and taxes.

- Loan term — Again, the average length of auto loans and leases has grown. Some auto loans have terms as long as 84 months — that's seven years of payments. Generally, a longer loan term will mean a lower monthly car payment — but a longer term can also mean more interest paid over the life of the loan.

How can I lower my monthly car payment?

If you're looking to lower your car payment, you have a few options. For example, you could increase your down payment so you don't need to borrow as much. Here are some other things you could consider.

Consider getting a cheaper car

Think about the most important features of your next vehicle. If you make some compromises, you might find a car that fits your needs without breaking the bank. Remember that smaller vehicles tend to have lower operating costs — and a used vehicle will likely cost less than a new one.

Negotiate your car price

Always research car prices before you buy so you know if what you're paying is in the right ballpark. Sites like Kelley Blue Book or AutoTrader can help. Try to negotiate each part of the deal separately, including the car's price, financing and any trade-in vehicle price.

Lease a vehicle

The monthly cost of leasing a new car can be a lot lower than it is for buying the same new car. Of course, with leasing, the car won't be yours to keep when the lease ends — unless you have the option of a lease buyout and the means to buy the vehicle outright or finance it.

Refinance your existing auto loan

If you've already bought your car with an auto loan, you still may be able to get a lower monthly payment by refinancing your loan. If you're able to refinance at an interest rate that's lower than your current one, that can help you save money.

Refinancing with a longer loan term also may lower your monthly payment, but you'll probably pay more interest in the long run.

Next steps

While you may not be able to control the rising purchase price of cars overall, you can make choices that affect the size of your car payment. As you develop your car budget, remember to factor in the other costs that come with vehicle ownership — like fuel, auto insurance and ongoing maintenance — as you consider how much you can afford to finance.

How Much Do People Get for a Car Loan

Source: https://www.creditkarma.com/auto/i/what-is-average-car-payment

0 Response to "How Much Do People Get for a Car Loan"

Post a Comment